Inherited ira rmd calculator vanguard

Resources for Small Business Entrepreneurs in 2022. Other than using the account owners age at death the calculation is identical to the one stated above.

Vanguard Rmd Calculator Fill Online Printable Fillable Blank Pdffiller

If you decide to take your Vanguard RMD from your outside.

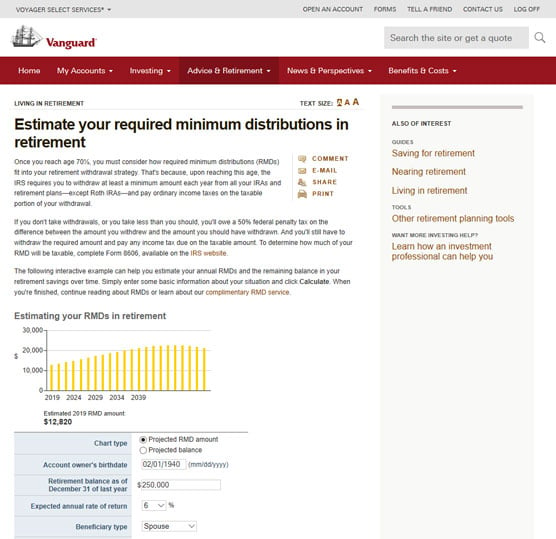

. What is the significance of an unconformity. By thousands of Americans. Account balance as of December 31 2021 7000000 Life expectancy factor.

Revised life expectancy tables for 2022 PDF Important calculator assumptions See your future RMDs and plan ahead. Take entire balance by end of 5th year following year of death or. If you have multiple Vanguard IRAs the RMD will be calculated separately for each IRA.

But if you want to defer taxes as long as possible there are certain distribution requirements with which you must. Company youll have a separate RMD for each account. Ad Use This Calculator to Determine Your Required Minimum Distribution.

Invest With Schwab Today. Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties.

In addition to calculating your RMD amount Vanguards RMD Distribution Service a free service allows you to set up your RMD to be automatically distributed each year. How is my RMD calculated. Calculate the required minimum distribution from an inherited IRA.

The penalty for missing an RMD from your inherited IRA is steep. 27 82 329 9708 barbara brown taylor prayer. RMD amounts depend on various factors such as the decedents age at death the year of death the type of beneficiary the account value and more.

0 Your life expectancy factor is taken from the IRS. Claim 10000 or More in Free Silver. If you want to simply take your inherited money right now and pay taxes you can.

Once enrolled you can view your RMD. If this situation occurs this calculator will use the account owners age when calculating RMDs. This is typically the current year.

Once enrolled you can view your RMD service online. You can use this calculator to help you see where you stand in relation to your retirement goal and map out different paths to reach your target. IRA owner dies before required beginning date.

To determine what your withdrawal options might be select the Identify Beneficiary Options button below. In general nonspouse beneficiaries that inherit an IRA from someone that passed away in 2020 or later may be required to withdraw the entire account balance within 10 years. For example although Roth IRAs dont have RMDs for the original account owner you must take an RMD if you inherit one.

Generally your required minimum distribution RMD for a given year must be withdrawn by December 31 of that year either in a lump sum or in installments. Vanguard will use the single life expectancy table to calculate the RMD for beneficiaries of inherited retirement plan accounts to the extent permissible under Internal Revenue Code Section 401a9 and the Treasury regulations thereunder. 89.

You can print the results for future reference and rest assured your data will not be saved online. Spouse may treat as herhis own. If inherited assets have been transferred into an inherited IRA in your name this calculator may help determine how much may be required to withdraw this year from the inherited account.

Ad Top Rated Gold Co. Protect your retirement with Goldco. Ready to run some numbers.

RMD amounts depend on various factors such as the beneficiarys age relationship to the beneficiary and the account value. Use Bankrates RMD Calculator to calculate these mandatory distributions. You must follow RMD rules when you inherit retirement accounts as well.

If youre RMD age Vanguard will automatically calculate the RMD amount each year for your tax-deferred IRAs and Individual 401ks held at Vanguard. You can add up those RMDs and make one withdrawal-either from your Vanguard IRA or the IRA at the other company-or you can split the withdrawals between the two accounts in any amounts youd lilRMD for both accounts. Use owners age as of birthday in year of death.

Specifically its 50 of the difference between the distribution amount required and what you actually withdrew. The rules are slightly different from those for your own account. Get prepared for the years ahead.

Learn More About American Funds Objective-Based Approach to Investing. Reduce beginning life expectancy by 1 for each subsequent year. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year.

However if youre taking an RMD for the first time you may delay withdrawing the RMD until April 1 of the year after the year you turn age 72 or in some cases until after the year you. Can take owners RMD for year of death. Ad Actionable Investing Ideas and Trends You Can Use to Help Clients Pursue Their Goals.

Receive small business resources and advice about entrepreneurial info home based business business franchises and startup opportunities for entrepreneurs. Use this calculator to determine your Required Minimum Distributions RMD as a beneficiary of a retirement account. Cyberpunk 2077 skill calculator.

What happened to mac on wmuz. Year of RMD The year to calculate the Required Minimum Distribution RMD. Request Your Free 2022 Gold IRA Kit.

Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. You can also explore your IRA beneficiary withdrawal options based on your circumstances.

The IRS has published new Life Expectancy figures effective 112022. Spousal beneficiaries and certain eligible nonspouse beneficiaries may be permitted to take RMDs over their life expectancy. Get The Freedom To Plan For Your Income Needs And Legacy Goals.

Inherited Ira Rmd Calculator Td Ameritrade

How To Take Money Out Of Your Ira Dummies

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

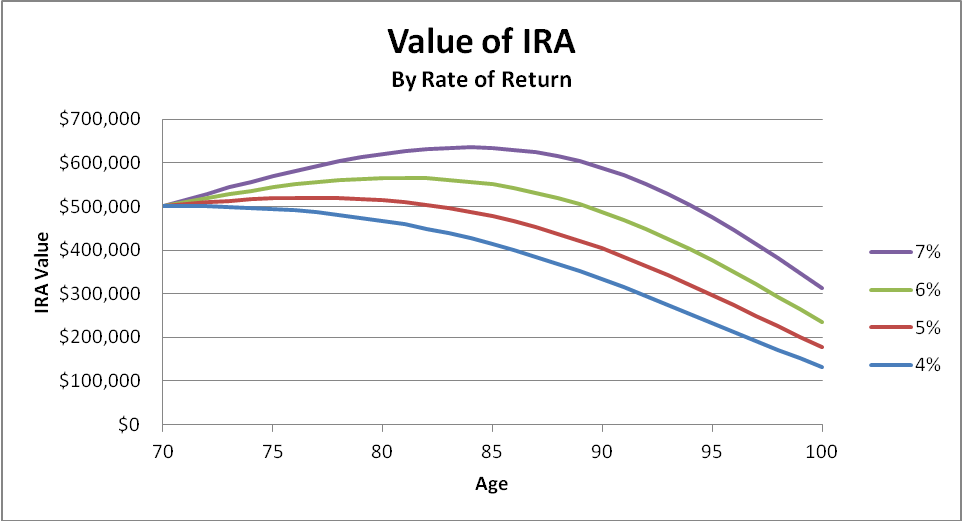

Retirement Cash Flow From Ira Rmds Seeking Alpha

Where Are Those New Rmd Tables For 2022

Can You Wait Until April 1 2022 To Take Rmd From Ira Inherited In 2021

Inherited Ira Rmd Calculator Powered By Ss Amp C

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Congressional Bill Could Bring Rmd Age Hikes Retirement Aid For Student Borrowers

Irs Wants To Change The Inherited Ira Distribution Rules

Inherited Iras Rmd Rules For Ira Beneficiaries Vanguard

Should I Use Dividends To Fund Rmds

Required Minimum Distributions Rmds Youtube

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition